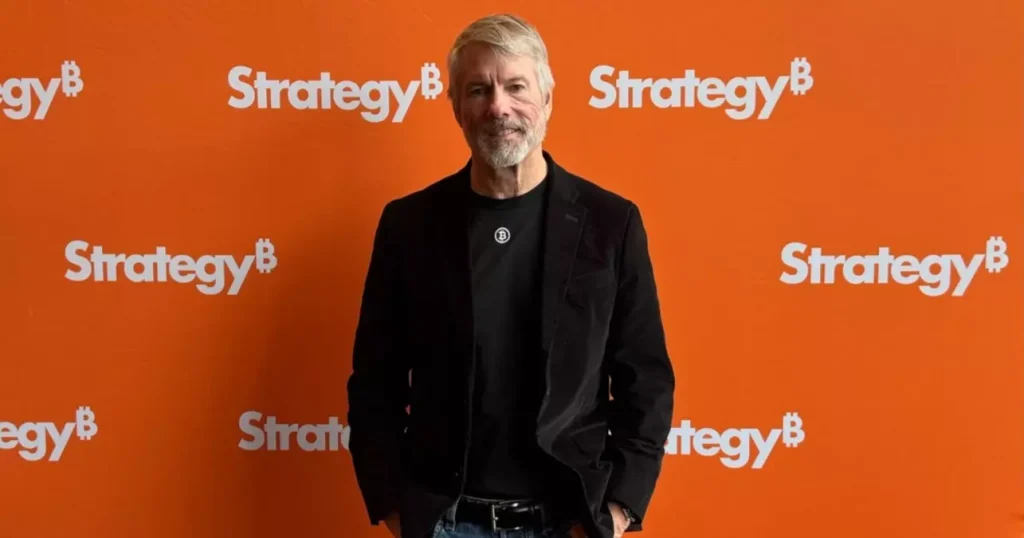

Michael Saylor, one of the most influential figures in the world of cryptocurrency, presented a clear vision of the future of Bitcoin at the Bitcoin 2025 event with his presentation titled “21 Ways to Wealth”. The co-founder of Strategy emphasized that he sees Bitcoin as stronger than all other investment instruments due to its programmable and incorruptible qualities.

Saylor: Bitcoin Will Leave Everything Behind

The most striking part of Michael Saylor’s speech was his call to investors to replace their traditional assets with Bitcoin. The Strategy leader, who stated that “Bitcoin was designed to leave everything behind,” advised, “Take your fiat currency, exchange it for Bitcoin.”

Highlighting Bitcoin’s programmable capital feature, Saylor argued that this quality would be crucial in the age of artificial intelligence. His statement that “all artificial intelligences will require programmable capital” resonated in the crypto sector.

Emphasizing the concept of intrinsic capital in corporate investment strategy, Saylor cited Japan-based Metaplanet as an example. Linking the company’s rise from $10 million to $5 billion in market value to its Bitcoin strategy, Saylor said, “A company can do this, an individual cannot.”

While Strategy’s current Bitcoin holdings have reached 580,250 BTC, the company announced last week that it purchased an additional 4,020 BTC. These data highlight the success of the corporate Bitcoin accumulation strategy.

Saylor also placed special importance on compliance. Emphasizing the importance of operating within the legal framework, he said, “You must create the best company you can within the rules of your market.”

In his presentation, Saylor shared insights into the future of Bitcoin and its potential to revolutionize the world of finance. His bold statements and strategic advice resonated with the audience, sparking discussions and reflections on the future of cryptocurrency and investment strategies.

Overall, Michael Saylor’s presentation at the Bitcoin 2025 event provided a comprehensive overview of the potential of Bitcoin and its role in shaping the future of finance. His insights and recommendations will likely influence the decisions of investors and companies looking to capitalize on the rise of cryptocurrency in the coming years.